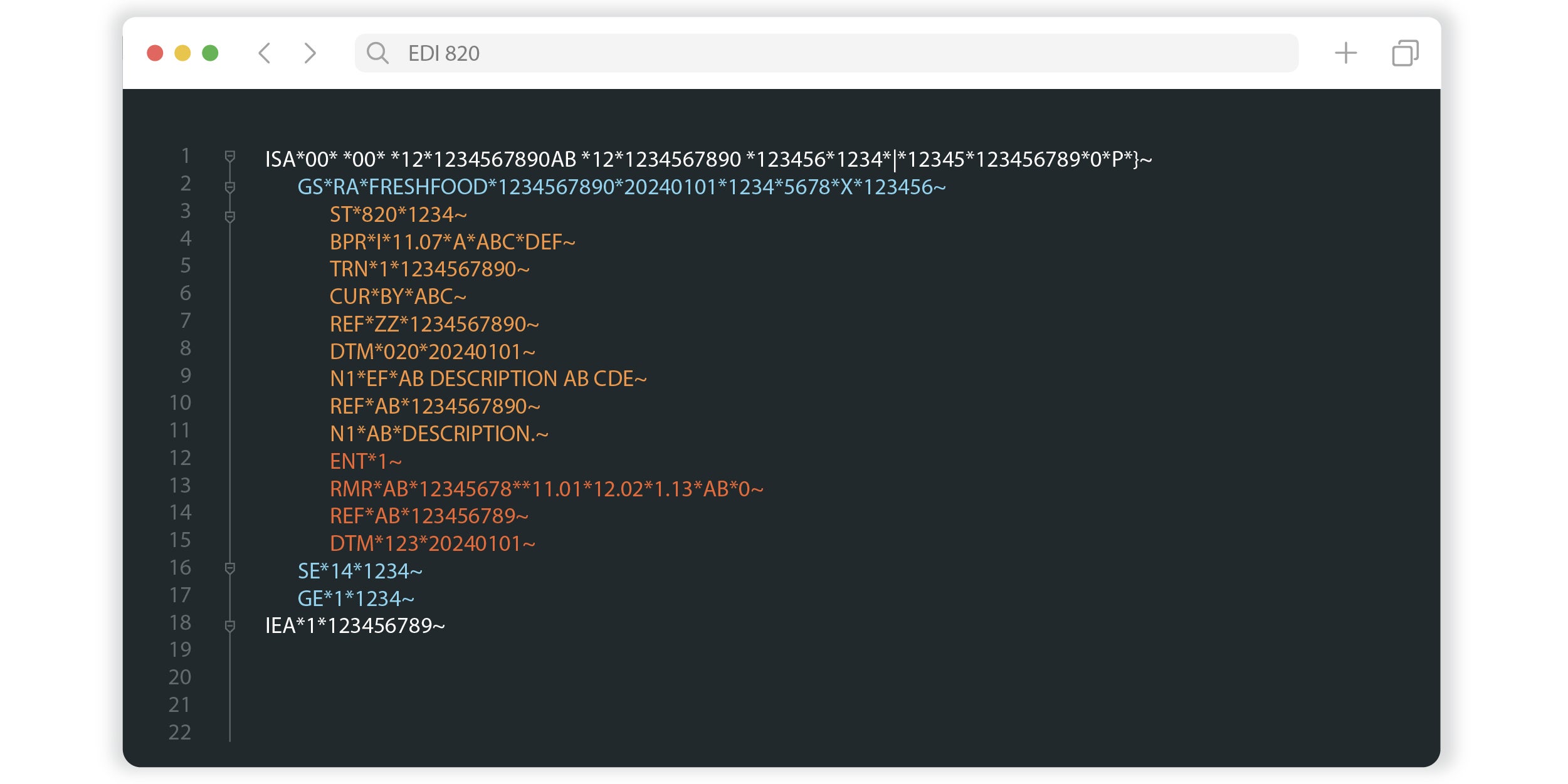

EDI 820 format

The EDI 820 is beneficial for automating the reconciliation process of payments with invoices, reducing manual effort and improving accuracy in financial transactions. It’s a critical component of the financial supply chain, ensuring that both parties have clear and consistent records of payments and their associated details.

The EDI 820 typically includes:

Payment order information: Details about the payment method and instructions.

How is the EDI 820 used?

The EDI 820 resembles a note the buyer gives to the store when they pay. It says, “I’m giving you this much money for this item.” The EDI 820 tells the store all about the money you’re giving them, like the amount, what kind of money it is (dollars, euros, etc.) and any identifying numbers that ensure its recorded as payment for the item. The EDI 820 helps the store keep track of what you paid for and confirms buyers give them the right amount of money.

Benefits of using the EDI 820 Payment Order

Have you been asking yourself “What is an EDI Payment?”. An EDI Payment, also known as the EDI 820 is used during the payment management phase of the order cycle. EDI transactions streamline the process of requesting payment, reconciling orders to payments, resolving discrepancies, and generating payments to suppliers, carriers or other third-party companies.

Both buyers and sellers benefit from implementing the EDI 820. Benefits include:

Buyer Benefits

Sending payment via EFT or wire transfer reduces the resources required to stuff envelopes and mail checks

Reduce the expense of postage and supplies

Improve trading partner collaboration by reducing unexpected charges, costs and deductions

Increase available credit for future purchases by enabling suppliers to apply payments faster

Seller Benefits

Receive advance notification of payments and visibility into payment details

Upload/import payment details using CSV formats into an accounting system without the need for manual data entry

Automate the reconciliation of payments

Understand payment discrepancies and resolve issues faster

Common issues regarding EDI 820

Most EDI transactions are between two trading partners. However, the 820 Payment Order/ Remittance Advice can be more complicated, because up to four parties may be involved: the payer, the payer’s bank, the payee and the payee’s bank.

Many accounts receivable departments use a manual process for invoicing and payment, which creates the potential for errors and delays. Often, information must be copied and pasted several times across multiple documents in order to process a payment. Reconciling payment details for eCommerce and drop-ship orders can be especially challenging when using a manual process.

Automate EDI 820 Remittance Advice with Full-Service EDI from SPS Commerce

Automate the EDI Payment with SPS Commerce so you can stop asking yourself “What is an EDI Payment?” and let us take care of it for you. Managing ongoing EDI tasks can be complex and time-consuming. Full-service EDI providers like SPS Commerce deliver EDI technology and associated staffing resources responsible for customizing, optimizing and operating your EDI solution.

With SPS Commerce Fulfillment, users can download the EDI 820 and other EDI documents to CSV files to easily translate invoice and payment information into a format for their system. These files can then be uploaded into an accounting system to cross-check information without manual entry. Accounting departments can get significant time back in their schedules and reduce errors by taking advantage of automated data exchange.

SPS communicates directly with your trading partners to manage connectivity, setup, requirements, updates and support efforts. SPS also takes ownership of understanding your trading partner requirements and making map changes.

SPS Fulfillment proactively monitors and optimizes your solution to prevent errors and minimize data entry.

Interested in learning more about our EDI solution?

Additional EDI Resources

Enter a virtual library of information about EDI for suppliers, vendors and distributors to provide you with the product knowledge you need to power your business.

Ultimate List of EDI Transactions

Here are some of the most common documents and transactions that are supported through EDI automation.

Five Top EDI Documents to Automate

When you automate your most-used EDI documents, it can significantly cut down keystrokes and speed up processes.

EDI Glossary

Terminology including retail definitions, order management models, supply chain roles, software and distribution channels.

EDI for Suppliers & Vendors

Discover how leading vendor and supplier businesses are serving their customers better with EDI solutions from SPS Commerce.