EDI 810 Format

The EDI 810 invoice is structured according to specific standards so it can be read and understood by various computer systems.

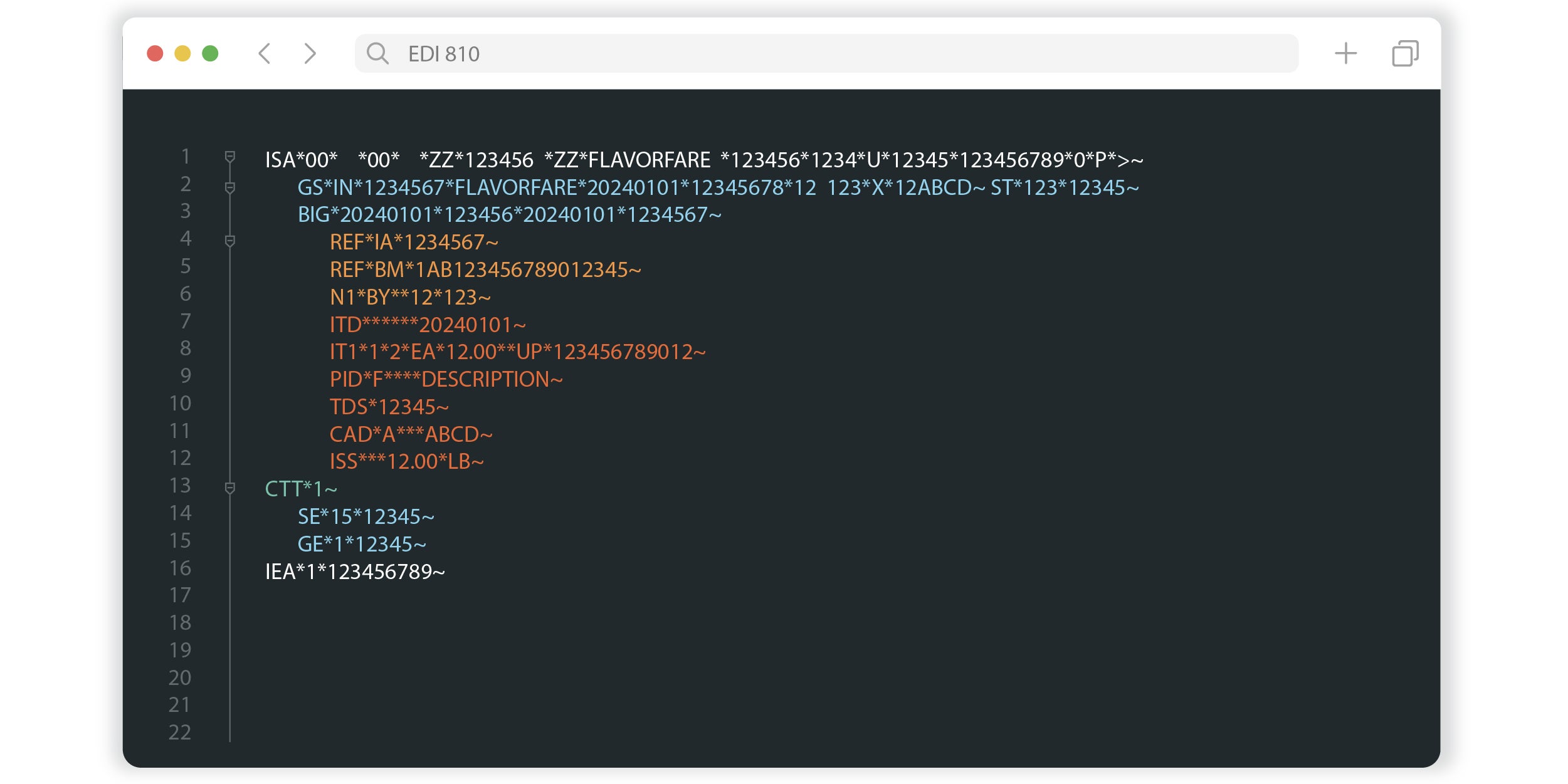

In the example image above, we see:

- IN is the invoice number segment

- BIG is the starting point segment which includes date, purchase order and release number

- TDS is the total amount due segment

- IT1 is the item identification segment, repeated for each item

- CAD is the carrier detail segment

The EDI 810 invoice typically includes information such as:

Benefits of using EDI 810 Billing

Both buyers (retailers) and sellers (suppliers) benefit from implementing the EDI 810. Benefits include:

Greater efficiencies and reduced paperwork for both parties

Faster reconciliation may result in a more timely payment for suppliers

Eliminate data entry errors associated with manual entry for both parties

Reduce administrative time spent manually submitting invoices (supplier) and manually entering invoices (buyer), allowing for resources to focus on value-added work

Common issues regarding EDI 810

Inconsistencies in the EDI Billing document may result in payment delays or short payments. Here are some common challenges:

Discounts:

Miscalculations or misrepresentations of discounts in the EDI Billing 810 document can cause invoices to be inaccurate.

Pricing:

If pricing is incorrect on the purchase order, the supplier’s invoice may not meet a retailer’s pricing expectations. Validating the pricing in the invoice against the pricing in the order can prevent overcharging or undercharging.

Invoices out of balance:

At times line items may not correctly add up to the invoice total due to data mapping or rounding errors. In this case, the retailer is likely to pay the lesser of the two amounts, resulting in short payments.

Automate EDI 810 – Invoice with Full-Service EDI from SPS Commerce

Managing ongoing EDI tasks can be complex and time-consuming. Full-service EDI providers like SPS Commerce deliver EDI technology and associated staffing resources responsible for customizing, optimizing and operating your EDI solution.

SPS communicates directly with your trading partners to manage connectivity, setup, requirements, updates and support efforts. SPS also takes ownership of understanding your trading partner requirements and making map changes.

SPS Fulfillment proactively monitors and optimizes your solution to prevent errors and minimize data entry. Interested in learning more about our EDI solution?

Additional EDI Resources

Enter a virtual library of information about EDI for suppliers, vendors and distributors to provide you with the product knowledge you need to power your business.

Ultimate List of EDI Transactions

Here are some of the most common documents and transactions that are supported through EDI automation.

Five Top EDI Documents to Automate

When you automate your most-used EDI documents, it can significantly cut down keystrokes and speed up processes.

EDI Glossary

Terminology including retail definitions, order management models, supply chain roles, software and distribution channels.

EDI for Suppliers & Vendors

Discover how leading vendor and supplier businesses are serving their customers better with EDI solutions from SPS Commerce.